Revenue generated from the country’s trade with foreign firms and institutions has declined by 6.73 per cent to GHȼ2.77 billion in the first half of the year.

This is against the GHȼ2.97 billion recorded for the same period last year.

The amount is also 20.63 per cent below the GHȼ3.49 billion projected to collect for the period.

This was contained in the 2019 half year provisional fiscal data from the Ministry of Finance.

Benchmark valuation of imports

Admitting that recent government policies such as the reduction in the benchmark valuation of imports could be a factor for the decline, a Fiscal Policy Specialist of Oxfam in Ghana, Dr Alex Ampaabeng, in an interview with the GRAPHIC BUSINESS on August 30 in Accra observed that he was hopeful that the policy would yield positive results in the coming years.

“I will not blame the benchmark value reduction wholly for the decline in the revenue collected from import duties for the first half of the year.

“Although it could be partly responsible as the full effect of this reduction which is expected to make us competitive will not be felt instantly but the initial revenue lost is expected.

He explained that he was optimistic of a strong performance in the second half of the year and so the difference for the past period could be addressed.

“The reduction in the benchmark values does not necessarily equate to a direct slash of import duty. However, it is expected to make us competitive as a country on our borders.

“Due to reductions in the benchmark, I expect traders in Mali, Niger and Burkina Faso who are all landlocked, to start considering Ghana as their transit point.

“And so, this reduction together with a smooth paperless system will surely improve revenue. Ghana cannot afford to be so expensive when neighbouring countries are being so competitive,” he said.

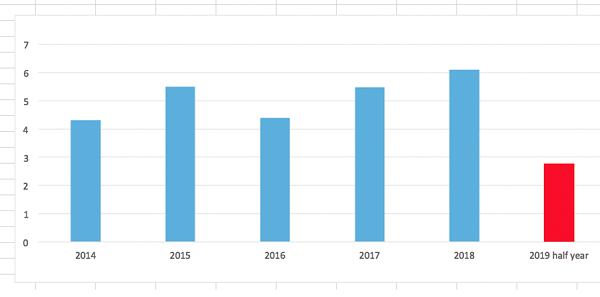

Revenue from import duties between 2014 and 2019 half year

Government policy

The government in April this year reduced benchmark valuation of imports for general goods by 50 per cent while that of vehicles also saw a 30 per cent reduction.

The move is to ensure an increase in the volume of imports through Ghana’s ports instead of through neighbouring countries. It is also to make Ghana’s ports competitive.

Before the reductions, data available showed that traffic at the Lome Harbour, for instance, has increased by some 300 per cent between 2013 and 2018 while that of Ghana has seen just a little over four per cent increment within the same period.

Encouraging figures

But Dr Ampaabeng stated that the although the revenue collected was 6.73 per cent below last year’s figure, it was quite encouraging, considering the slash in benchmark values which ultimately impacted on total receipts for the first half of the year.

“However, there is still a large gap of 20 per cent against the target of GHȼ3.49 billion. There is the need to critically assess what went wrong so we can correct this to help improve our overall poor domestic revenue mobilisation (DRM) performance.

“The government must be praised for the good measures put in place in the last few years. Plugging the leakages could be the main factor making the difference,” he said.

Graphic